DGAP-News: Brockhaus Capital Management AG / Key word(s): IPO/Capital Increase 09.07.2020 / 19:25 The issuer is solely responsible for the content of this announcement. NOT FOR DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA, NEW ZEALAND, SOUTH AFRICA

Continue readingBrockhaus Capital Management AG: Technology group BCM successfully completes its private placement ahead of the planned listing at € 32.00 per share

Brockhaus Capital Management AG / Key word(s): IPO/Capital Increase Brockhaus Capital Management AG: Technology group BCM successfully completes its private placement ahead of the planned listing at € 32.00 per share 09-Jul-2020 / 18:51 CET/CEST Disclosure of an inside information acc. to Article 17

Continue readingCitigroup Global Markets Limited: Pre Stabilisation Notice

DGAP-News: Citigroup Global Markets Limited / Key word(s): Miscellaneous 07.07.2020 / 11:30 The issuer is solely responsible for the content of this announcement. NOT FOR DISTRIBUTION OR PUBLICATION IN THE UNITED STATES, CANADA, AUSTRALIA, OR JAPAN OR ANY OTHER JURISDICTION IN WHICH THE DISTRIBUTION

Continue readingBrockhaus Capital Management AG: Technology group BCM sets placement price for its private placement ahead of the planned listing on Frankfurt Stock Exchange at € 32.00 per share

DGAP-News: Brockhaus Capital Management AG / Key word(s): IPO 07.07.2020 / 08:00 The issuer is solely responsible for the content of this announcement. NOT FOR DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA, NEW ZEALAND, SOUTH AFRICA OR JAPAN OR ANY

Continue readingBrockhaus Capital Management AG: Technology group BCM envisages listing on the Frankfurt Stock Exchange

DGAP-News: Brockhaus Capital Management AG / Key word(s): IPO 29.06.2020 / 08:24 The issuer is solely responsible for the content of this announcement. NOT FOR DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA, NEW ZEALAND, SOUTH AFRICA OR JAPAN OR ANY

Continue readingBrockhaus Capital Management acquires IHSE Group

Oberteuringen / Frankfurt a. M., 18 December 2019 – Brockhaus Capital Management AG (“BCM”) a technology group focused on majority investments in highly profitable and -growing technology and innovation leaders, has acquired a 100% stake in IHSE Group (“IHSE”) for an enterprise value of around € 135 million. IHSE is a global technology leader for high-performance IT infrastructure components for latency and loss-free, as well as ultra-secure transmission of “mission critical” data. Following the acquisition of sensorics specialist Palas in late 2018, this represents another important milestone for BCM towards its envisaged IPO.

Based in Oberteuringen near Lake Constance, IHSE Group has been developing and selling cutting-edge IT infrastructure solutions within the KVM market (keyboard, video, mouse) for 35 years. Through KVM technology, computer signals can be transmitted, transformed and bidirectionally extended, enabling latency and loss-free, as well as ultra-secure separation of workstations from their corresponding servers. As a cross-sectional technology, IHSE products are used in a wide range of end-markets, especially those, where cyber-attacks can have serious consequences (such as air traffic control, broadcasting, healthcare, industry, transport or banking). As such, IHSE benefits from numerous global megatrends (including autonomous driving or industry 4.0) as well as the corresponding increase in “mission critical” and highly sensitive data transmission. The group employs more than 110 employees at sites in Germany, the US and Singapore.

The previous shareholders Brockhaus Private Equity III and EL-Invest mandated Lincoln International to run a competitive, structured sell-side process. Within this auction, BCM managed to prevail as a bidder and acquired IHSE-Group for an enterprise value of around € 135 million. IHSE’s managing directors, Dr. Enno Littmann (CEO) and Michael Spatny (CSO), will continue to lead the group and, together with other key employees of the firm, have significantly reinvested as part of this transaction.

“As an integral part of BCM Group, IHSE is now ideally positioned to explore and harness the continued growth potential inherent in new regions and further areas of application”, comments IHSE CEO Dr. Littmann. “This will be feasible not least because BCM as a technology group in form of a stock corporation is set to support us for the long term and, in contrast to conventional financial investors, has no pre-determined investment horizon”, says Littmann. “Furthermore, BCM’s team can draw upon 20 years’ worth of experience in identifying and developing strongly growing technology companies and therefore is the ideal partner with regard to the further growth phases that lie ahead of IHSE”, adds Littmann.

“The successful acquisition of IHSE Group is another milestone for us and the management’s decision to significantly reinvest fully confirms us in our strategy”, explains BCM CEO Marco Brockhaus. “Our long-term investment strategy coupled with our strict focus on highly profitable and -growing technology leaders, such as IHSE-Group, makes us stand out in Germany as a pioneer whose merits are being recognized and appreciated by investors as well as entrepreneurs. This paves the way for us, not only towards further acquisitions, but also towards our envisaged IPO”, adds Brockhaus.

About BCM

BCM AG (www.bcm-ag.com) is a technology group focused on long-term majority investments in highly profitable and growing technology and innovation leaders in B2B markets. Within this segment, the team around BCM can draw upon a successful track record that spans 20 years. As a technology group in the form of a stock corporation, BCM is able to support its portfolio companies over the long term without any pre-determined investment horizons, while offering investors the opportunity to participate on a sustainable and long-term basis in the group’s development.

About IHSE Group

IHSE Group (www.ihse.de) is a global technology leader for high-performance IT infrastructure components for latency and loss-free, as well as ultra-secure transmission of “mission critical” data. Based in Oberteuringen near Lake Constance, IHSE has been developing and manufacturing switches for computers and consoles as well extenders for loss-free transmission of computer signals for 35 years. As a cross-sectional technology, IHSE products are used in a variety of end-markets characterized by “mission critical” data transmission, enabling the firm to benefit from increasing connectivity and digitalization. The group employs more than 110 employees at sites in Germany, the US and Singapore.

About Brockhaus Private Equity

Brockhaus Private Equity (www.brockhaus-pe.com) was founded in 2000 in Frankfurt am Main, Germany. As an independent growth investor specializing in buyouts and expansion financings, Brockhaus Private Equity focuses on innovation and technology leaders in the German speaking regions, respectively managing and advising funds with a total volume of more than € 285 million. The funds make equity and equity-related investments in the range of € 5 million to € 25 million per transaction.

For media inquiries, please contact:

USC

Phone +49 221 280 655 16

Mobile +491726963574

E-Mail ie@us-communications.com

Mühlengasse 7

50667 Köln

Brockhaus Capital peilt IPO 2020 an

Von Walther Becker, Frankfurt, Börsen-Zeitung, 27.9.2019

Marco Brockhaus, der mit seiner Private-Equity-Gesellschaft früh an Wirecard und 360T (an die Deutsche Börse verkauft) beteiligt war, strebt möglichst im nächsten Jahr an die Börse. Er geht davon aus, dass die 2017 gegründete Brockhaus Capital Management AG (BCM) dann reif und fit ist für den Prime Standard, wie er im Gespräch mit der Börsen-Zeitung sagte. Seine Vision: ,,die profitabelste Technologiegruppe in Deutschland‘‘ – mit langfristigem Horizont.

Bekannt wurde der heute 51-Jährige in der Szene mit der 2000 gegründeten Brockhaus Private Equity, die drei Fonds aufgelegt hatte. BCM soll Investoren die Möglichkeit bieten, sich an wachsenden und profitablen ,,Hidden Champions‘‘ über den Kauf von Aktien zu beteiligen. Zudem werde auf die in Private Equity üblichen Managementgebühren und Erfolgsbeteiligungen verzichtet, hatte er angekündigt.

Nach einer Kapitalerhöhung von 50 Mill. Euro läuft nun die nächste Privatplatzierung an, die bis zu 100 Mill. Euro einspielen soll. Investoren seien Family Offices, Unternehmer und Manager – auch von bisherigen Portfoliofirmen. War der Aufbau im Dezember 2018 mit dem Partikelmesstechnikspezialisten Palas aus Karlsruhe gestartet worden, so hat Brockhaus zwei neue Deals in petto: in IT und Medtech. Dafür soll der Mittelzufluss aus der Kapitalerhöhung genutzt werden. Sind die Transaktionen in trockenen Tüchern, sei die BCM, die anders als Private Equity nicht immer auf den Exit schielen soll, börsenreif. ,,Wir suchen Innovationsführer mit Wachstumsperspektiven von mindestens 25% im Jahr und Margen von jenseits 30 %‘‘ (vor Steuern, Zinsen und Abschreibungen), sagt Brockhaus. Und die kriege man auch. Palas sei zu nicht einmal dem 10-Fachen des Ebitda erworben worden. Allerdings habe BCM, an der Brockhaus und sein Team nach der Kapitalerhöhung etwa ein Drittel halten wollen, auch ,,mehr als 1000‘‘ mögliche Fälle gescreent und sei drei Due Diligences angegangen. ,,Wir sind extrem selektiv‘‘, betont er. Und solche Deals sind nicht so leicht zu einer attraktiven Bewertung zu finden, auch wenn Brockhaus nach 20 Jahren im Markt über ein größeres Netzwerk verfügt, auf M&A-Berater hört und sich auf Branchenmessen tummelt.

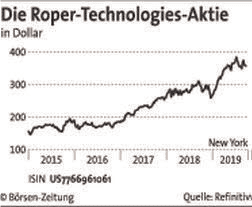

Brockhaus‘ Vorbild ist die Beteiligungsgesellschaft Ropers Technologies aus Florida, die seit 1992 an der Nasdaq notiert ist, stetig steigende Ergebnisse generiere und den gleichen Fokus habe wie Brockhaus. Ihre Portfoliofirmen sorgten 2018 für Umsätze von 5,1 Mrd. Dollar, ein Ebitda von 1,7 Mrd. und einen freien Cash-flow von 1,4 Mrd. Dollar. Roper hat das, was Brockhaus vorschwebt, im Programm: Die Vorteile von Private-Equity-Returns aus Direktbeteiligungen mit der liquiden Aktie zu vereinen. Die Nachteile der Fondsstruktur – Wertpotenziale wegen des Exitdrucks auf dem Tisch liegen zu lassen – sollen mit dem Wegfall des Private-Equity-Investmentzyklus vermieden werden.

Brockhaus Capital Management acquires particle measurement specialist Palas

Karlsruhe / Frankfurt am Main, 06. December 2018 – Brockhaus Capital Management AG (BCM), an independent technology holding focused on investments in innovation and technology leaders, becomes new majority shareholder of particle measurement specialist Palas GmbH. Based in Karlsruhe, Palas develops technologically leading high-precision devices for measuring, characterizing and generating particles in air, particularly in the field of fine dust and nanoparticles. Following a successful private placement end of 2017, this investment by BCM marks another milestone towards its planned IPO.

BCM has acquired a majority stake in Palas GmbH as part of a succession arrangement. Co-founder and current majority shareholder, Leander Mölter, is leaving the company following the transaction. Dr. Maximilian Weiß, long-time CEO and Head of R&D and Production, who is also a minority shareholder, will continue to hold a significant minority stake in the firm and manage it as CEO.

With its unique optical measurement technology and more than 20 active patents, Palas is the global technology leader in high-precision devices for measuring particles in air. The product portfolio includes certified fine dust and nanoparticle measurement devices, aerosol spectrometers and -generators as well as associated systems and software solutions. With over 270 clients from more than 60 countries – including BASF, Siemens, BMW and Bayer – Palas’ products are particularly in demand in the public sector, pharmaceutical industry, medical technology, manufacturing industry, automotive industry as well as laboratories and cleanrooms. The market for particle measurement technology enjoys strong growth due to an increasing global awareness for air pollution related health risks and the tightening of regulatory standards that results from it.

“Our successful succession arrangement paves the way for us to continue our extraordinary growth story”, explains Leander Mölter, founder and resigning shareholder of Palas. “In choosing our new majority shareholder, it was decisive for us that BCM is not only very familiar with the requirements of fast growing medium-sized technology leaders and capable of supporting us through its broad network of industry experts, but also ideally positioned as a technology holding, unlike conventional financial investors, to be our partner for the long term because of the absence of fixed investment horizons”, adds Mölter.

“The global market for particle measurement technology is currently going from strength to strength, not least because of growing awareness of severe health hazards triggered by air pollution and the tighter regulation introduced in response”, says Dr. Maximilian Weiß, CEO of Palas and responsible for the development and launch of Fidas, the company’s current flagship device for measurement of fine dust. “The unique technology know-how and outstanding network of our new majority shareholder BCM will enable us to forge ahead with our successful expansion, not least by conquering new international markets and additional areas of application for our products”, adds Weiß.

“As an experienced technology investor who played a key role in the success stories of firms such as Wirecard and 360T, we are convinced that Palas as a global technology leader is in a class of its own”, comments Marco Brockhaus, CEO of BCM. “The company offers a truly unique optical technology for particle measurement and is ideally positioned within a fast-growing niche driven by global megatrends. As such, Palas offers not only exceptional dynamics coupled with high profitability, but also first-class long-term growth prospects. For us, the acquisition of Palas is a key milestone in the build-up of the BCM portfolio and the path to our planned IPO”, adds Brockhaus.

About Palas

Palas GmbH (https://www.palas.de) is a leading developer and manufacturer of high-precision devices for generating, measuring and characterizing particles in air. With more than 20 active patents, Palas develops technologically leading and certified fine dust and nanoparticle measurement devices, aerosol spectrometers, -generators and -sensors as well as associated systems and software solutions. Palas was founded in 1983 and has approximately 70 employees who are based at the firm’s headquarters in Karlsruhe.

About BCM

BCM AG (https://www.bcm-ag.com) is focused on long-term investments in technology driven and innovation led growth companies in the German-speaking region. In this segment, the team behind BCM has established a longstanding successful track record. The company invests in fast growing firms with proven strengths in innovation and aims at achieving a sustainable value appreciation of its portfolio companies. As a technology holding in form of a stock corporation, BCM offers investors the opportunity to participate in this value creation.

For media inquiries, please contact:

USC

Phone +49 221 280 655 16

Mobile +491726963574

E-Mail ie@us-communications.com

Mühlengasse 7

50667 Köln

Citigroup Global Markets Limited: Exercise of Greenshoe Option – AKASOL AG

DGAP-News: Citigroup Global Markets Limited / Key word(s): Miscellaneous 27.07.2018 / 18:00 The issuer is solely responsible for the content of this announcement. NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA OR JAPAN.AKASOL AGStabilization

Continue readingCitigroup Global Markets Limited: Pre Stabilization Notice – AKASOL

DGAP-News: Citigroup Global Markets Limited / Key word(s): Miscellaneous 20.06.2018 / 07:29 The issuer is solely responsible for the content of this announcement. NOT FOR DISTRIBUTION OR PUBLICATION IN THE UNITED STATES, CANADA, AUSTRALIA, OR JAPAN.Notification of Stabilization Measures in accordance

Continue reading